Between Christmas and New Year’s Day, here at Millard Fillmore’s Bathtub we celebrate a variety of historically holy days. December 31, by tradition, is Bright Idea Day, the anniversary of the day Thomas Edison demonstrated for the public a working light bulb in 1879.

100,000 people gather in Times Square, New York City, tonight, and millions more around the world, in festivities for the new year made possible by the work of Thomas Alva Edison.

Here it is, the invention that stole sleep from our grasp, made clubbing possible, and launched 50,000 cartoons about ideas:

The light bulb Thomas Edison demonstrated on December 31, 1879, at Menlo Park, New Jersey – Wikimedia image (GFDL)

The light bulb. It’s an incandescent bulb.

It wasn’t the first bulb. Edison a few months earlier devised a bulb that worked with a platinum filament. Platinum was too expensive for mass production, though — and Edison wanted mass production. So, with the cadre of great assistants at his Menlo Park laboratories, he struggled to find a good, inexpensive filament that would provide adequate life for the bulb. By late December 1879 they had settled on carbon filament.

Edison invited investors and the public to see the bulb demonstrated, on December 31, 1879.

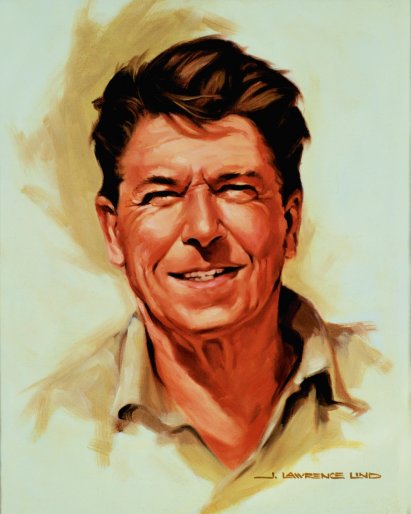

Thomas Edison in 1878, the year before he demonstrated a workable electric light bulb. CREDIT: Thomas Edison, head-and-shoulders portrait, facing left, 1880. Prints and Photographs Division, Library of Congress. Reproduction number LC-USZ62-98067

Edison’s successful bulb indicated changes in science, technology, invention, intellectual property and finance well beyond its use of electricity. For example:

- Edison’s Menlo Park, New Jersey, offices and laboratory were financed with earlier successful inventions. It was a hive of inventive activity aimed to make practical inventions from advances in science. Edison was all about selling inventions and rights to manufacture devices. He always had an eye on the profit potential. His improvements on the telegraph would found his laboratory he thought, and he expected to sell the device to Western Union for $5,000 to $7,000. Instead of offering it to them at a price, however, he asked Western Union to bid on it. They bid $10,000, which Edison gratefully accepted, along with the lesson that he might do better letting the marketplace establish the price for his inventions. Other inventive labs followed Edison’s example, such as the famous Bell Labs, but few equalled his success, or had as much fun doing it. (Economics teachers: Need an example of the marketplace in action?)

- While Edison had some financial weight to invest in the quest for a workable electric light, he also got financial support, $30,000 worth, from some of the finance giants of the day, including J. P. Morgan and the Vanderbilts who established the Edison Light Company.

- Edison didn’t invent the light bulb — but his improvements on it made it commercial. “In addressing the question ‘Who invented the incandescent lamp?’ historians Robert Friedel and Paul Israel list 22 inventors of incandescent lamps prior to Joseph Wilson Swan and Thomas Edison. They conclude that Edison’s version was able to outstrip the others because of a combination of three factors: an effective incandescent material, a higher vacuum than others were able to achieve (by use of the Sprengel pump) and a high resistance lamp that made power distribution from a centralized source economically viable.”

- Edison’s financial and business leadership acumen is partly attested to by the continuance of his organizations, today — General Electric, one of the world’s most successful companies over the past 40 years, traces its origins to Edison.

Look around yourself this evening, and you can find a score of ways that Edison’s invention and its descendants affect your life. One of the more musing effects is in cartooning, however. Today a glowing lightbulb is universally accepted as a nonverbal symbol for ideas and inventions. (See Mark Parisi’s series of lightbulb cartoons, “Off the Mark.”)

Even with modern, electricity-saving bulbs, the cartoon shorthand hangs on, as in this Mitra Farmand cartoon.

Or see this wonderful animation, a video advertisement for United Airlines, by Joanna Quinn for Fallon — almost every frame has the symbolic lightbulb in it.

Other resources:

- New Netherlands Institute biography of Edison

- A timeline noting Edison’s many inventions

- Light bulbs and other electric lamps, and color

- Earlier post at Millard Fillmore’s Bathtub on the granting of the patent for Edison’s invention

- The 100+ year-old lightbulb in Livermore, California

- Forth Worth’s 100-year-old lightbulb (If there are two lightbulbs more than 100 years old and still burning, are there others?)

- Wait a minute! What about that lightbulb he demonstrated on October 21? Story here. See the difference?

- Oh, yeah — it’s a good enough idea, we can celebrate it often: January 27 is the anniversary of the granting of the patent

Thomas Edison’s electric lamp patent drawing and claim for the incandescent light bulb CREDIT: “New Jersey–The Wizard of Electricity–Thomas A. Edison’s System of Electric Illumination,” 1880. Prints and Photographs Division, Library of Congress. Reproduction Number LC-USZ62-97960.

Yeah, this is mostly an encore post.

Even More, in 2012 and 2013:

- On This Day In 1879, Edison Demonstrates The Incandescent Light Bulb (rememberinghistory.wordpress.com)

- OSHA Declares Light Bulbs A Workplace Hazard (smartsign.com)

- Incandescent lightbulbs face final lights out (kitv.com)

- Historical AC DC debate between Edison and Tesla (faizankhalid.wordpress.com)

- The 75-Watt Bulb Has a Dim Future (businessweek.com)

- In January, the government will finally kill Thomas Edison’s light bulb (rare.us)

- Era of incandescent bulbs near end (triblive.com)

- Many popular light bulbs will disappear in 2014 (stltoday.com)

Posted by Ed Darrell

Posted by Ed Darrell